THIS COULD

BE YOUR

HOME:BUWOG ALVA

Comfortable living between Berlin and Potsdam

Red clinker brick, the expansive blue sky above, and two lakes in the neighbourhood – this is what living is all about in BUWOG ALVA. The modern apartments are located in historic buildings that are only two storeys high and have a total of three levels due to an habitable top floor.

THIS COULD

BE YOUR

HOME:BUWOG ALVA

Comfortable living between Berlin and Potsdam

Red clinker brick, the expansive blue sky above, and two lakes in the neighbourhood – this is what living is all about in BUWOG ALVA. The modern apartments are located in historic buildings that are only two storeys high and have a total of three levels due to an habitable top floor.

BUWOG ALVA at a glance

106 condominiums

1.5 – 5 rooms

43 – 140 m² living space

BALCONIES, TERRACES

BUWOG ALVA CONSTRUCTION PHASE

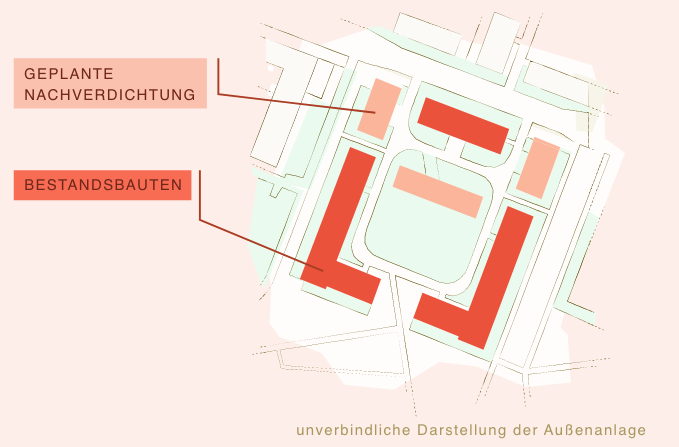

BUWOG ALVA is the first construction phase of BUWOG’s Lillestad development.

The Swedish name Alva means “fairy”. How fitting that BUWOG ALVA is making the silent wish of three listed existing buildings come true: to be renovated, modernised and filled with new life. The three beautiful clinker brick buildings once belonged to the Krampnitz Cavalry School. We are now devoting careful attention to refurbishing them for modern living requirements – at which point the choice will be yours. Would you prefer your new home to be located in a small side street of the development or on the lively promenade of Schwedische Allee?

Experience BUWOG ALVA in our project film:

PRESERVING

MAINTAIN AND

WHILE

PROFITING

Claim tax deductions for the refurbishment share

Purchasing a listed residential property is not only worthwhile because of the special charm of historic buildings. In Germany, the preser vation of architectural treasures is subsidised by tax deductions. These make it possible to effectively deduct the refurbishment costs for a residential property used by the owner or rented to a third party for tax purposes, thereby reducing taxable income.

This results in the following advantages:

Faster refinancing of investment costs

Reduction of the tax burden in the initial years

Encrease in liquidity.

This noticeably enhances the attractiveness of listed properties.

When buying for your own use:

Beneficiary refurbishment costs for an owner-occupied residential property can be claimed against tax at up to 9% p.a. over ten years in the case of listed buildings.

This means that 90% of the beneficiary refurbishment costs are tax-deductible after just 10 years.

Calculation example Section 10f of the German Income Tax Act (EStG) –

Refurbishment costs covered € 300,000

| Year | Tax benefit p. a. | Tax benefit (with a sample tax rate of 30%) |

|---|---|---|

| 01 | 9 %: 27.000 € | 8.100 € |

| 02 | 9 %: 27.000 € | 8.100 € |

| 03 | 9 %: 27.000 € | 8.100 € |

| 04 | 9 %: 27.000 € | 8.100 € |

| 05 | 9 %: 27.000 € | 8.100 € |

| 06 | 9 %: 27.000 € | 8.100 € |

| 07 | 9 %: 27.000 € | 8.100 € |

| 08 | 9 %: 27.000 € | 8.100 € |

| 09 | 9 %: 27.000 € | 8.100 € |

| 10 | 9 %: 27.000 € | 8.100 € |

| TOTAL | 270,000 € | 81,000 € |

For purchase as a capital investment:

When letting, the depreciation rates for listed residential properties are higher than for other properties: eligible refurbishment costs can be offset against tax at up to 9% p.a. over 8 years and up to 7% p.a. over the following 4 years. This means that 100% of the eligible refurbishment costs are tax-deductible after just 12 years.

Calculation example for monument depreciation Section 7i of the German Income Tax Act (EStG) – subsidised refurbishment costs € 300,000

Your tax advisor can answer all your questions about your depreciation options and your personal tax advantages. Talk to him and we will be happy to show you the right properties for you.

| Year | Tax benefit p. a. | Tax benefit (with a sample tax rate of 30%) |

|---|---|---|

| 01 | 9 %: 27.000 € | 8.100 € |

| 02 | 9 %: 27.000 € | 8.100 € |

| 03 | 9 %: 27.000 € | 8.100 € |

| 04 | 9 %: 27.000 € | 8.100 € |

| 05 | 9 %: 27.000 € | 8.100 € |

| 06 | 9 %: 27.000 € | 8.100 € |

| 07 | 9 %: 27.000 € | 8.100 € |

| 08 | 9 %: 27.000 € | 8.100 € |

| 09 | 7 %: 21.000 € | 6.300 € |

| 10 | 7 %: 21.000 € | 6.300 € |

| 11 | 7 %: 21.000 € | 6.300 € |

| 12 | 7 %: 21.000 € | 6.300 € |

| TOTAL | 300,000 € | 90,000 € |

Our service for you as an investor:

- All-round carefree package

- Optimal financing

- Convenient administration

- Simple set-up with Roomhero: buwog.roomhero.de

Further information on the topic of capital investment can be found here:

Private investors | BUWOG Bauträger GmbH

Are you interested in the BUWOG ALVA CONSTRUCTION PHASE?

Arrange a non-binding consultation using the contact form.

Our competent experts will be happy to advise you. We will be pleased to answer any questions.

Back to the Lillestad Quarter

Monument – AfA: claim the beneficiary purchase price share for tax purposes!

Invitation to the real estate purchase information evening on 20.11.2025 at 5 pm. Register here!

Monument – AfA: claim the beneficiary purchase price share for tax purposes!

Invitation to the information evening on buying real estate on 20.11.2025 at 5 pm.

Register here!